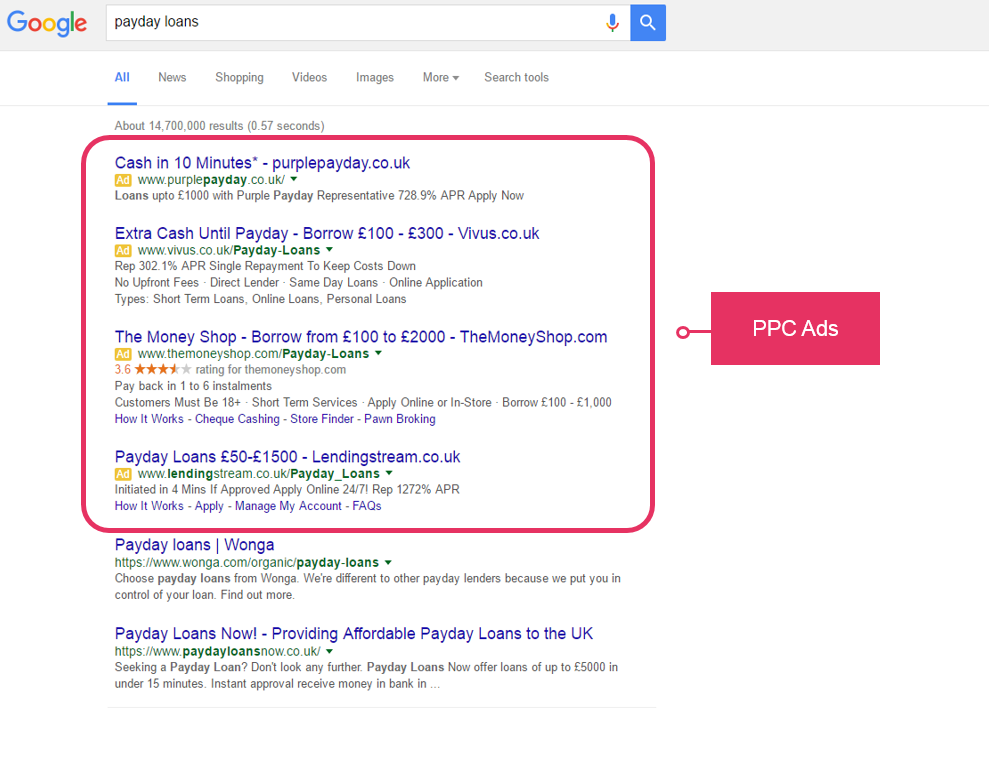

Last week, Google announced a change to its AdWords policy around payday loans, banning ads for products with high APRs and short repayment terms.

I’ve been talking to a payday loan provider, and we’ll also look at this decision from Google, made seemingly for moral reasons.

“Today we’re sharing an update that will go into effect on July 13, 2016: we’re banning ads for payday loans and some related products from our ads systems. We will no longer allow ads for loans where repayment is due within 60 days of the date of issue.

In the U.S., we are also banning ads for loans with an APR of 36% or higher. When reviewing our policies, research has shown that these loans can result in unaffordable payment and high default rates for users so we will be updating our policies globally to reflect that.”

So has Google done this for moral reasons?

Well, payday loans can certainly be harmful products. Most quote something like 700% APR or above. It will typically cost in the region of £90 to borrow £200 for three months. This is steep, but the longer term loans offered by such sites are worse, while late or missed payment fees can be extortionate.

This move will not necessarily stop payday loans companies bidding on the term, but they will be limited on the types of product they can advertise.

The obvious effect is that this removes a fast path to market for newer payday loan firms who sometimes offer even worse terms than the more well-know brands. If they can’t pay for PPC, they’ll need to work on a longer-term SEO strategy to gain any visibility on Google.

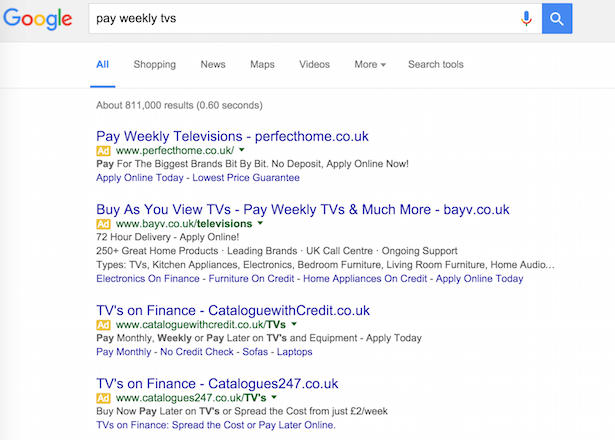

However, Google still allows other products which could be harmful. For example, there are plenty of ads for home electronics which can be paid in instalments, at some very unfavourable terms.

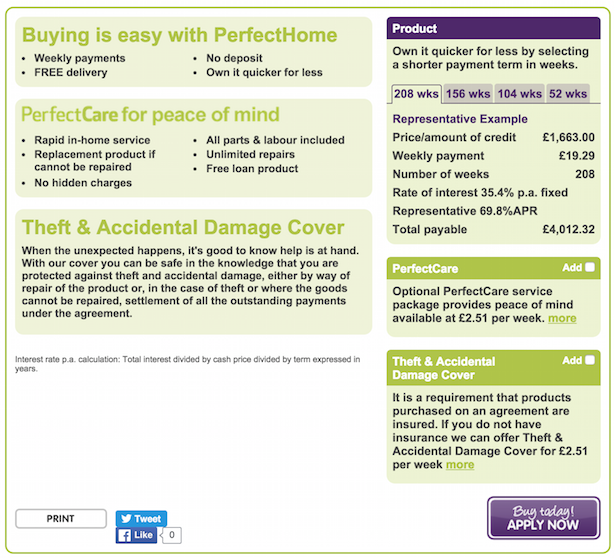

For example, one of the ads above leads to this LG TV, which can be bought for around £1,600 on several sites.

However, with the interest here, customers will end up paying back more than £4,500 (the compulsory insurance adds another £522 to the cost). This can be just as damaging as a payday loan.

Of course, we also have categories such as gambling. Indeed, gambling terms make up 77 of the top 100 PPC keywords in the UK. Gambling can destroy.

So, it’s an interesting one. Google has chosen to take a moral stand on payday loans, but there are many other legal but potentially harmful products or industries which have no restrictions.

A win for Wonga?

The most obvious effect is that, by removing PPC ads for such products, this benefits the established players in the market, Wonga et al.

No PPC ads means that newer entrants to the market no longer have a quick route to the top of the SERPs, and will find it hard to beat the organic dominance of the established players.

As Will Critchlow puts it:

How many companies would jump at a deal that meant that neither they *nor their competitors* could buy search ads? https://t.co/ZRZ0xPqjgf

— Will Critchlow (@willcritchlow) May 12, 2016

Jonathan Beeston echoes this view:

Searchers will still be able to find payday loans firms through the Organic results. For strong brands listed in a high position, this policy change might be beneficial. Competitors and new entrants won’t be able to buy their way to the top.

Data from SimilarWeb suggests Wonga.com gets 37.5% of its desktop traffic from search, but 99.1% of that is organic. At worst this change will be neutral for Wonga, and quite possibly they’ll do well out of it.

The stats back this argument up. According to data from PI Datametrics, the best performing sites by SEO visibility are Wonga and the more recognisable brands in the sector.

Those paying for PPC ads at the moment seem to be the ones with less organic visibility, none of those listed in the chart above.

For example, the site with the second PPC ad has little or no organic footprint.

So, to answer the question, it looks like a win for Wonga and similar lenders. Though, as Jonathan Beeston pointed out, it may also help fintech startups:

The other winners from this change maybe Fintech startups. Plenty of companies are trying to disrupt the poor credit lending space, such as Lendup and Lending Club. It’s worth noting Lendup has taken investment from Google Ventures. Lending Club received money from Google itself. I’ll let the conspiracy theorists take it from here.

The payday lender’s view

I asked Luke Enock, Director of Online at Satsuma Loans, about Google’s decision.

“We welcome Google’s announcement. It marks an important watershed for the non-standard consumer lending market as it makes a clear distinction between well-regulated online credit providers like Satsuma, with its stringent affordability checks, transparent pricing and no hidden extra charges on the one hand, and less customer-focused payday lenders on the other.”

Presumably this now benefits those lenders with a better organic search strategy, as well as saving on PPC spend?

“Google aren’t taking these companies out of the SERPs from organic so I can still see these businesses operating in the short term. Unless Google launches a new algorithm update that targets these companies and removes them from the SERPs as well, but I can’t see this happening any time soon. Organic and paid teams really speak to each other.

There is a need for companies like Satsuma Loans to operate, about one in seven people in the UK can’t get loans from banks, so unless Google is suddenly playing God and saying that these people suddenly can’t have any credit to help when an unexpected bill arrives, then they must still allow reputable companies to bid.

Non payday loan companies I am assuming will still be able to bid on the terms – Google haven’t said they won’t accept bid for the term, just payday loan companies won’t be allow to bid them on their network.

So for us PPC will still be a key channel, but just means some of the people we are bidding against drop out – but others will come in.”

In summary

Whatever the reason for Google’s decision, it seems that this move will serve to further establish the more recognisable lenders in this sector. As these are more likely to be regulated than newer entrants, this does have some benefits for consumers.

It also underlines the importance of SEO in competitive markets like this. While PPC has offered a faster route to search visibility for many, those brands which have looked longer-term and put an SEO strategy in place look set to benefit here.

No comments:

Post a Comment